Explainer: Who will pay the price for Trump's "big, beautiful bill?"

Xinhua

04 Jul 2025, 16:15 GMT+10

Critics have slammed the "One Big Beautiful Bill Act" for its skewed distribution of benefits, tilting toward wealthier groups.

WASHINGTON, July 4 (Xinhua) -- The U.S. Congress on Thursday passed a sweeping tax and spending package, with the House of Representatives approving it in a narrow 218-214 vote, sending the "One Big Beautiful Bill Act" to President Donald Trump for his signature.

As a cornerstone of Trump's second-term domestic agenda, the bill seeks to extend his 2017 tax cuts and introduce new reductions, such as exemptions for tips and overtime, amounting to an estimated 4.5 trillion U.S. dollars in tax relief. It also allocates hundreds of billions of dollars for border security and national defense.

Corporations, manufacturers and high-income individuals emerge as clear winners under the bill thanks to favorable tax provisions. Industries tied to national security and immigration services are also expected to benefit.

However, critics have slammed the bill for its skewed distribution of benefits, tilting toward wealthier groups. The following outlines how the legislation is likely to harm specific industries and social groups.

"ROBIN-HOOD-IN-REVERSE" POLICY

The legislation has been widely described as a "Robin Hood in reverse," as it disproportionately benefits the wealthiest Americans at the expense of the poor.

Among the deepest spending cuts are reductions to Medicaid and food stamps by tightening eligibility standards and enforcing stricter work requirements. The nonpartisan Congressional Budget Office (CBO) estimated that, if the bill becomes law, an additional 11.8 million Americans would lose health insurance by 2034, and more than 3 million would become ineligible for food stamps.

An analysis by Yale University's Budget Lab projected that under the Senate version of the bill, the bottom 20 percent of U.S. earners would see their after-tax incomes decline by approximately 2.9 percent, equivalent to about 700 dollars per year. In contrast, the top 20 percent would see their after-tax incomes rise by roughly 2.2 percent, or about 5,700 dollars annually.

Democratic Senator Bernie Sanders has called the legislation "a gift to the billionaire class," citing data showing that the richest 1 percent of Americans would receive 975 billion dollars in tax breaks, while the top 0.2 percent would benefit from 211 billion dollars in estate tax exemptions.

Hospitals have voiced strong opposition to the bill's healthcare provisions, particularly those that would reduce state support for Medicaid, which would shift more financial burden onto hospitals.

Rick Pollack, CEO of the American Hospital Association, warned that the bill could result in the curtailing of essential services and the closure of hospitals.

PUSHING NATIONAL DEBT HIGHER

Market insiders have warned of the potential consequences this bill could have on the rapidly expanding U.S. public debt, which has already reached an astonishing 36 trillion dollars.

According to the CBO, the package is projected to add nearly 3.3 trillion dollars to federal deficits between 2025 and 2034.

JPMorgan Chase CEO Jamie Dimon recently cautioned that mounting federal deficits could eventually unsettle investors. In a June 16 interview with FOX Business, he said, "At some point, the bond markets are going to struggle," adding, "I can't say whether that's in six months or six years."

Adding trillions to the debt could push interest rates higher, making it more costly for Americans to buy cars or homes, and for businesses to borrow money. Higher rates would also compel the federal government to pay more for its debt interest expense, economists say.

U.S. Representative Thomas Massie of Kentucky, a deficit hawk, was one of two Republicans who voted against the bill on Thursday. He argued that the legislation would explode the national debt and fail to rein in spending.

Tech billionaire Elon Musk, once a close ally of Trump, has repeatedly criticized the bill. Posting on X on Tuesday, he declared, "Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their heads in shame!"

UNDERCUTTING CLEAN ENERGY FUTURE

As part of sweeping spending cuts, the bill eliminates major clean energy incentives, including tax credits for electric vehicles (EVs) and energy-efficient home upgrades.

While the Senate ultimately dropped a last-minute excise tax on wind and solar -- a measure experts had warned would have been a "killer" for the industry -- the final bill still delivers a major blow to renewable energy. Under the legislation, key tax incentives for wind, solar and other clean energy projects will be phased out by 2027, with tighter conditions imposed for those seeking to claim them.

According to projections from think tank Energy Innovation and researchers at Wellesley College's Environmental Studies Department, the bill threatens 4,500 clean energy projects, puts hundreds of thousands of jobs at risk, and could add billions of dollars to Americans' annual energy bills within five years, Newsweek reported.

EV makers also stand to lose under the new legislation. Before the bill's passage, buyers could receive a 7,500-dollar federal tax credit for new EVs and up to 4,000 dollars for used ones. Those incentives were originally designed to help make the vehicles more affordable.

The broader implications of the bill have also sparked sharp criticism from environmental advocates. "It's clear that this deeply unpopular bill favors burning more fossil fuels while ignoring the damage it will do to people's lives," said Joanna Slaney, vice president for political and government affairs for the Environmental Defense Fund.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chile Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chile Sun.

More InformationSouth America

SectionRoundup: Trump targets foreign tourists with higher national park fees

President Trump has ordered higher entrance fees for foreign visitors to U.S. national parks, sparking concerns from environmental...

ECSSR, Anwar Gargash Diplomatic Academy launch first regional edition of 'Hili Forum' in Brazil

ABU DHABI, 4th July, 2025 (WAM) --The Emirates Centre for Strategic Studies and Research (ECSSR) and the Anwar Gargash Diplomatic Academy...

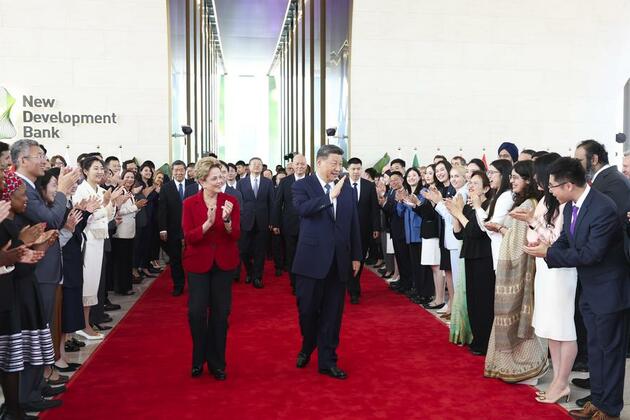

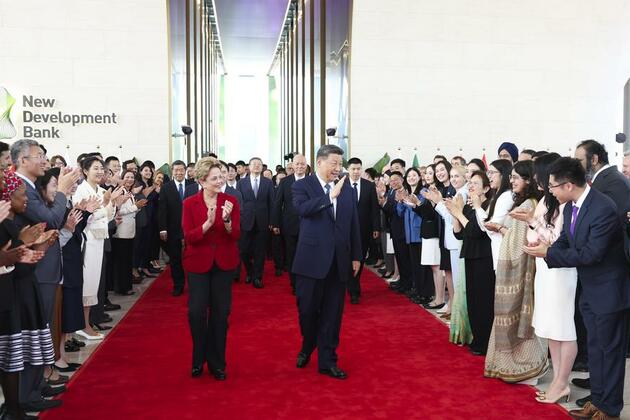

Xi pushes for Global South modernization via practical cooperation

BEIJING, July 4 (Xinhua) -- Ahead of Chinese President Xi Jinping's state visit to Brazil late last year, the Portuguese edition of...

Xi's long-standing commitment to Global South development

BEIJING, July 4 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese metropolis of Shanghai sits...

PM Modi receives Guard of Honour in Trinidad and Tobago, welcomed by Caribbean nation's PM, 38 Ministers and 4 MPs

Port of Spain [Trinidad and Tobago], July 4 (ANI): Prime Minister Narendra Modi began his first official visit to Trinidad and Tobago...

Xi Jinping champions the cause of Global South

by Xinhua writer Jiang Hanlu BEIJING, July 3 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese...

World

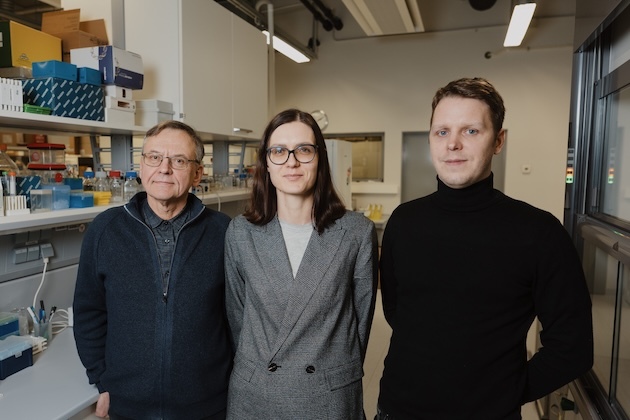

SectionMethionine Restriction Could Extend Lifespan, Boost Health

VILNIUS, Lithuania – A growing body of research suggests that selectively restricting a single nutrient in our diet could have profound...

Kiev cant turn tide on battlefield spy chief

Ukrainian forces are unlikely to repel Russia but peace talks could bring about change, Kirill Budanov has said Kiev lacks the ability...

Israel awaits Hamas response on US-backed ceasefire, Trump offers guarantee for permanent peace

Washington [US], July 4 (ANI): As Israel awaits Hamas's response on Friday to the latest proposal for a hostage release and ceasefire...

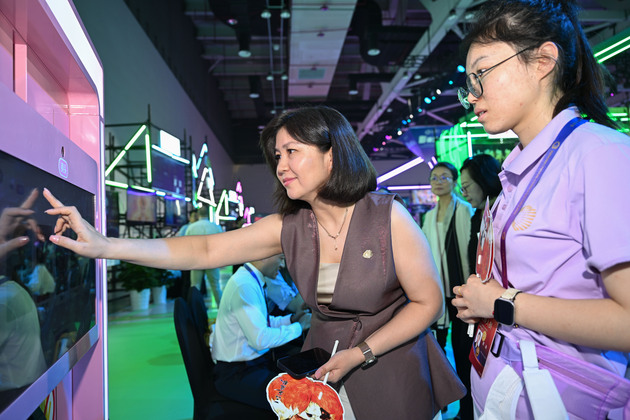

CHINA-CHONGQING-SCO-MOVIE FESTIVAL (CN)

(250704) -- CHONGQING, July 4, 2025 (Xinhua) -- A guest interacts with an exhibit at the Yongchuan International Convention and Exhibition...

Explainer: Who will pay the price for Trump's "big, beautiful bill?"

Critics have slammed the One Big Beautiful Bill Act for its skewed distribution of benefits, tilting toward wealthier groups. WASHINGTON,...

German businesses fear military draft would drain labor FT

Economic prosperity and the governments push to arm to confront Russia are reportedly seen as conflicting goals Struggling German...